Current State of the Market & What's Next #7

At the moment I’m writing this, the greatest short-term uncertainty for crypto is the trajectory of interest rates.

What Powell signals at Jackson Hole (Thu, Aug 22) and how the Fed sets the rate dots at the Sept 16–17 FOMC.

Dovish tone → 2Y yields and DXY ease → BTC/ETH pump

Hawkish cut or higher-for-longer → risk comes off and alts dump first

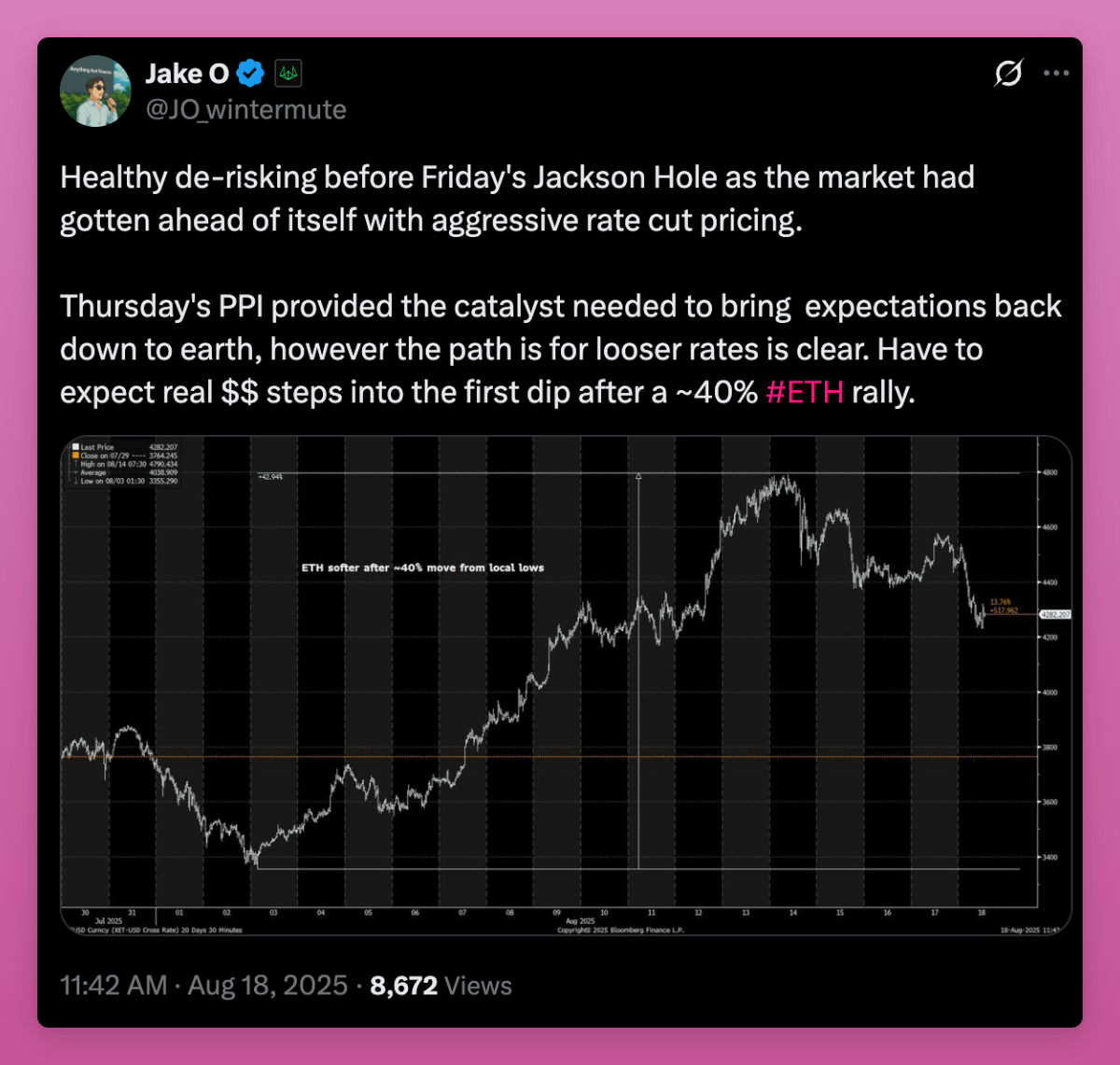

That’s the results of ChatGPT 5 Thinking and Deepseek’s Deepthink models. But many on X agree, explaining the recent altcoin dip.

Tbh, crypto's reliance on macro factors is frustrating, but the last cycle topping with global rate hikes shows we can't ignore them.

Yet as Jake from Wintermute says above, so do my AI models paint a bullish future: interest rate cuts are coming. The uncertainty is when, how often and how steep are the cuts.

Thus we are at the exact opposite of how the last cycle ended: cuts are coming, so bull market top is farther away than we think?