Current State of the Market & What's Next #8

Everyone is feeling it. Less excitement, fewer TGEs and announcements.

Your timeline is quieter. AI posts and rage-bait dominates.

But is it real or just vibes?

Looking at the data… it is real.

But the story is more interesting than ‘crypto is dying.’

Airdrop shill (not sponsored)

Variational’s Omni is a perp DEX on Arbitrum with a points program that started in December 2025.

Traders earn points based on volume, and referrals add a bonus. !!50%!! of the total $VAR token supply will be airdropped so early trading positions for a potential airdrop.

Key details:

Zero maker and taker fees

Loss refunds paid out (over $2 million refunded to date)

RFQ model for P2P trades with onchain settlement

This setup differs from other order-book DEXes.

It supports long-tail assets and plans to add equities, RWAs, and forex.

Funding: $10.3 million seed round in 2024 plus $1.5 million strategic in 2025.

Investors include Bain Capital Crypto, Peak XV, Coinbase Ventures, Dragonfly, Mirana, and Caladan.

WHY I LIKE IT: Access is invite-only. Less competition. Less noise.

👉Sign up on omni.variational.io and use my referral code: OMNIIGNAS

Developer numbers

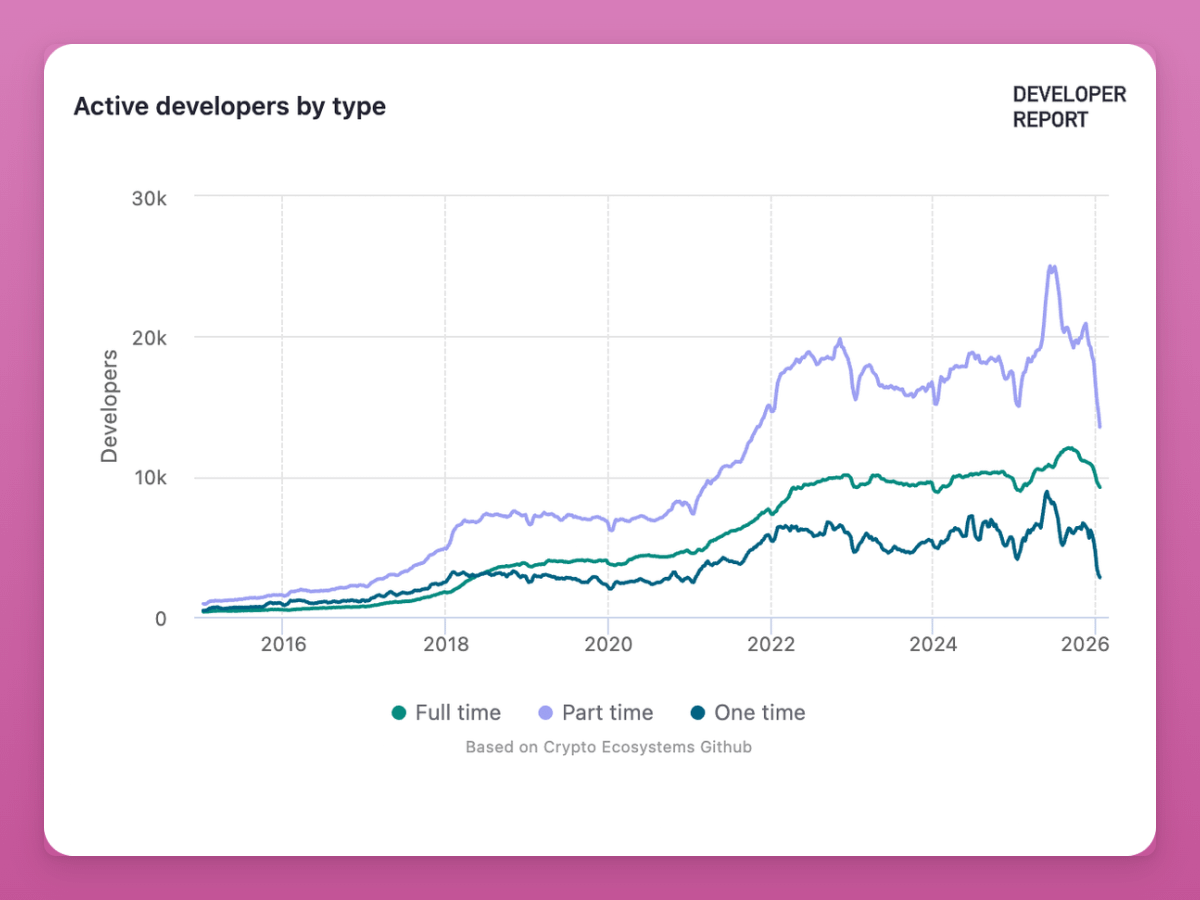

Look at active developers by type:

Part time devs: huge growth to 25k in mid 2025 then crashed to around 12k now

One time devs: crashed from 8k to 2.8k now. Lowest since 2020!

Full time devs: steady growth to all time highs at 12k and trending down for now.

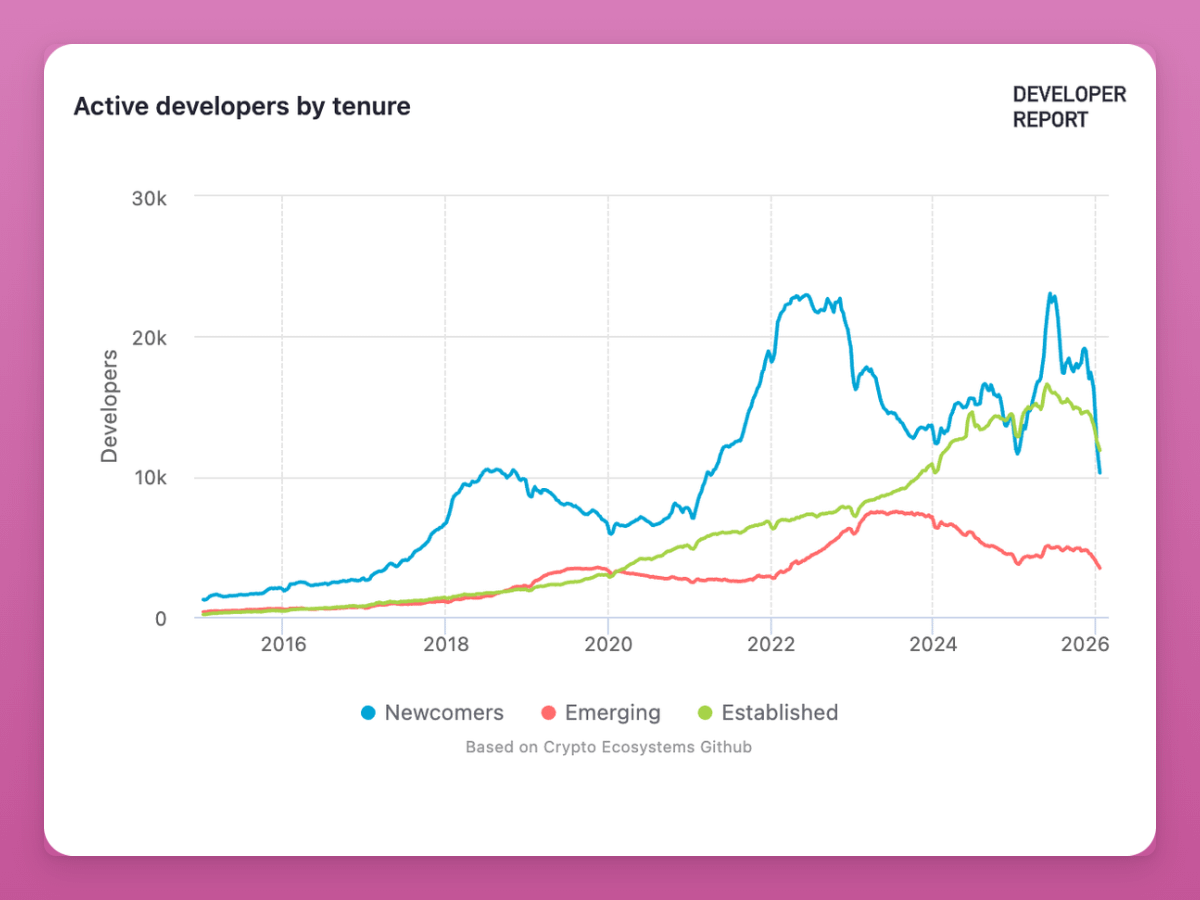

Now look at tenure:

Newcomers: peaked at 23k in 2022, and again in mid 2025, now crashed to around 10k

Emerging devs: down by 50% from 8k peak to around 4k now

Established devs (2+ years): steady climb to ATHs and trending down

The decline is mostly part timers and newcomers leaving. The 2024-2025 cycle brought a wave of devs chasing easy money with airdrops and token incentives. When those dried up they left.

But full time devs and established devs (2+ years experience) are still near ATHs despite a decline.

Interestingly, the full-time established devs continued to grow during previous bear cycle, yet this time they are decreasing.

This has me worried.

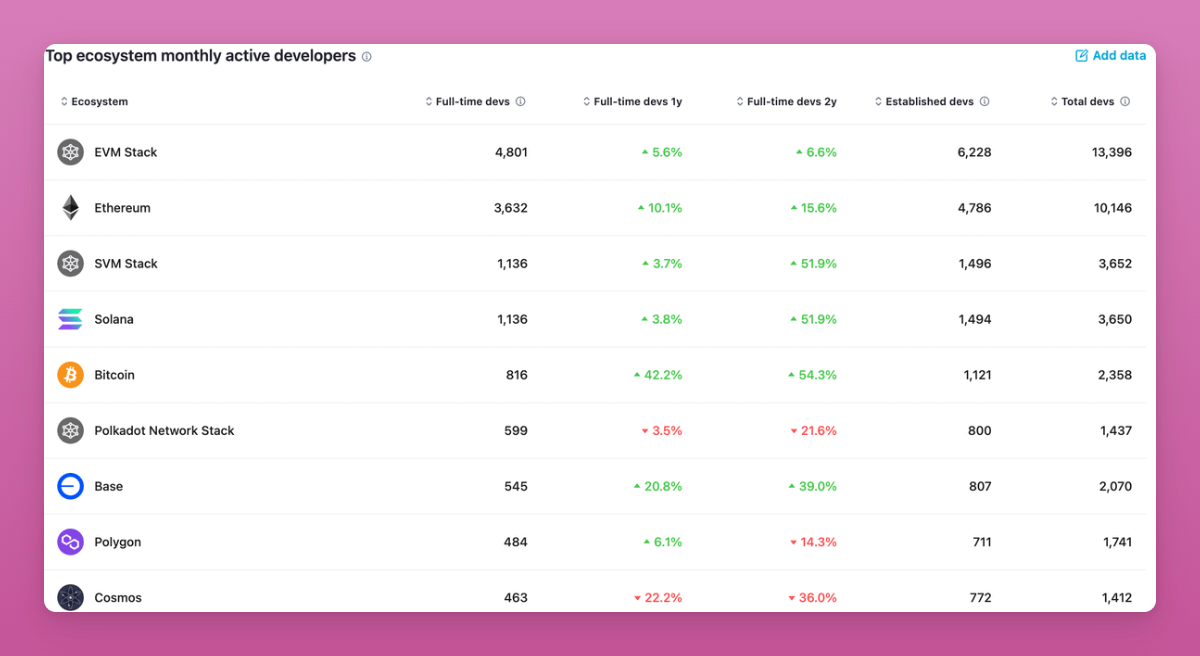

Who left and who stayed

Breaking down this down by ecosystem the picture becomes less bearish:

Bitcoin’s +42% is the surprise thanks to Ordinals, inscriptions, and L2s bringing devs back.

Ethereum: +10.1% with 10,146 devs in total Still dominant. Base looking healthy too.

Solana: +3.8% year over year but +51.9% over 2 years!

The 2021 alt L1s (Polkadot, Cosmos) are dying. You can check full data here.

Full time devs on major chains are actually growing. The decline we saw in other charts is part timers and newcomers leaving, not the core builders.

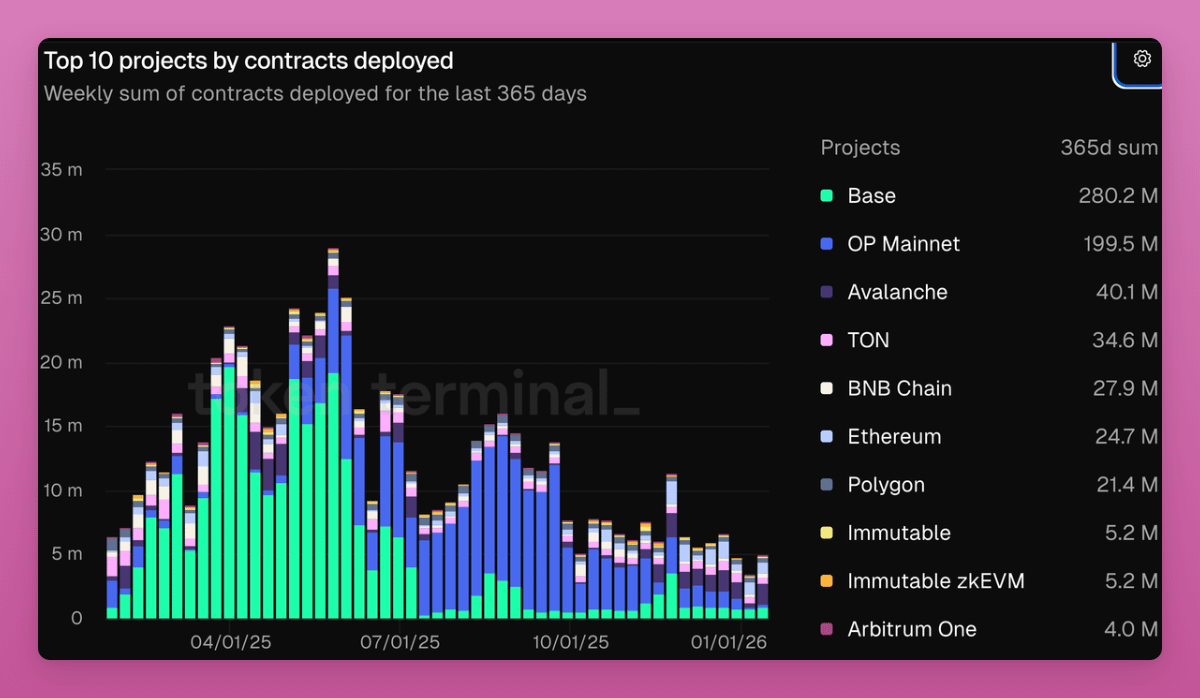

Side note: notice the drop in contracts deployed.

Speculative altcoin/memecoin mania died off from Base in July leading to a big drop in activity. This, however, does not include Solana with which picture would look even worse.

Which leads us to…

Token launches collapsed

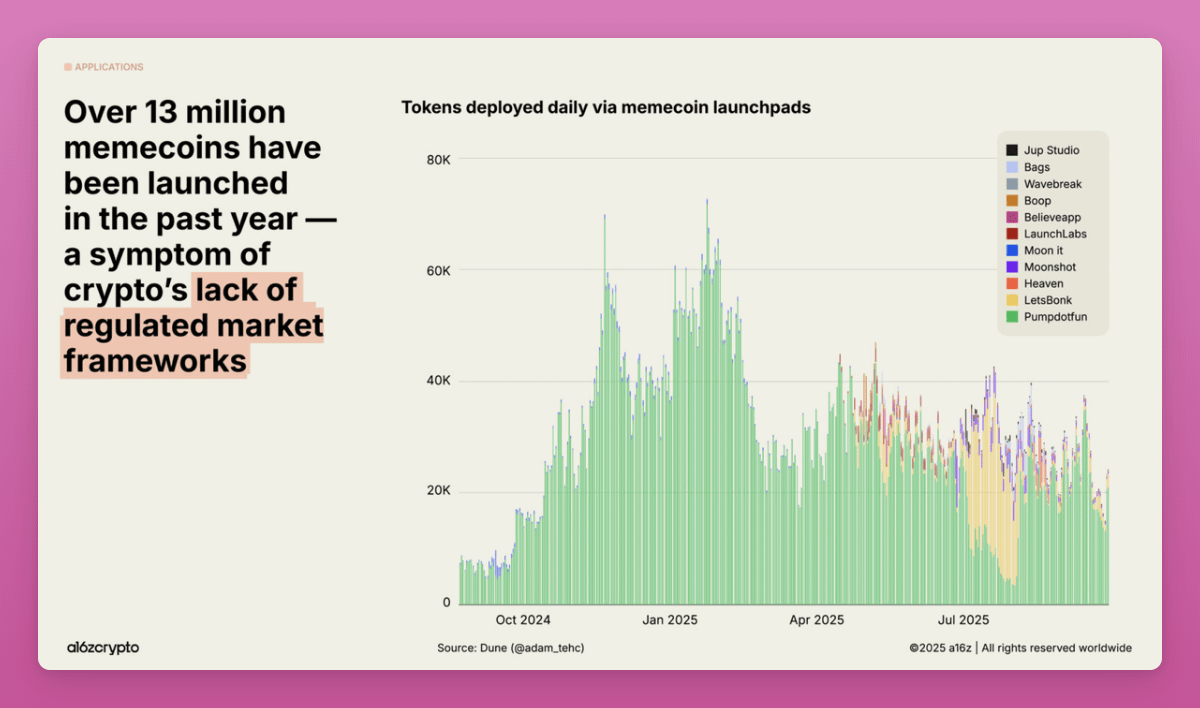

More than 13 million memecoins launched in the past year but September 2025 had 56% fewer launches than January 2025.

We printed more tokens than ever.

CoinGecko tracked that 53.2% of all coins they’ve listed are now dead (trading volume under $1,000 for three months).

And 86.3% of all coin failures happened in 2025.

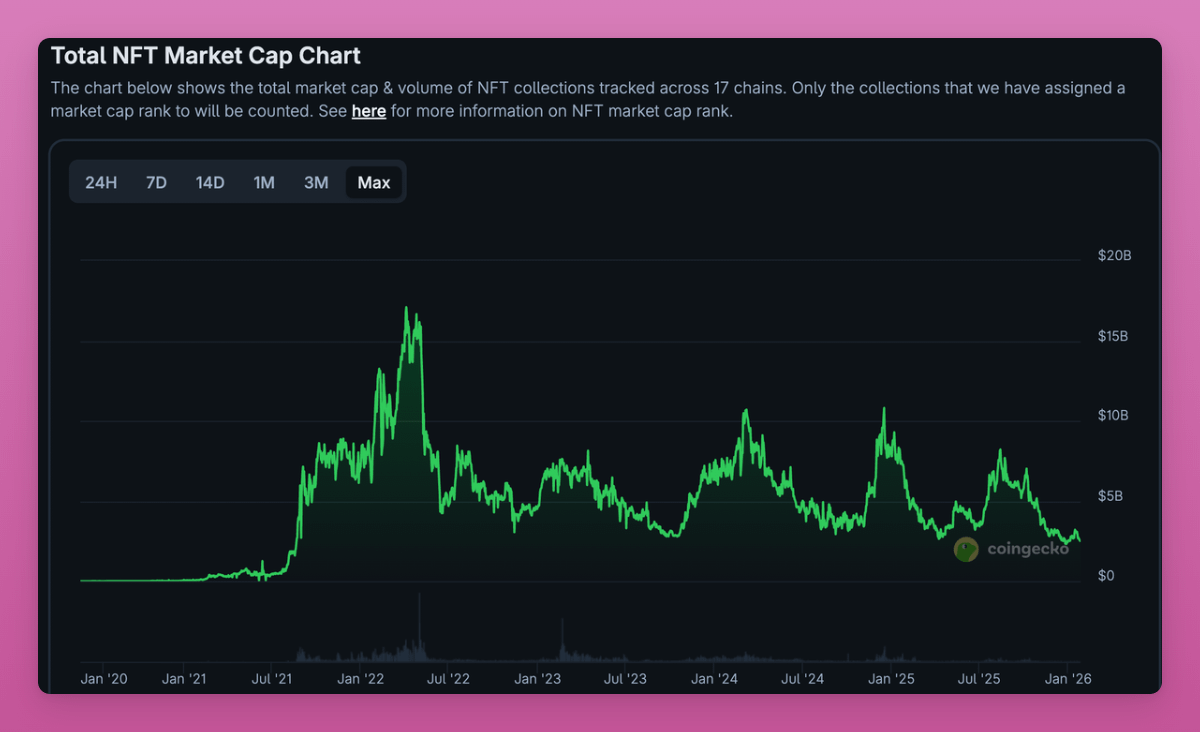

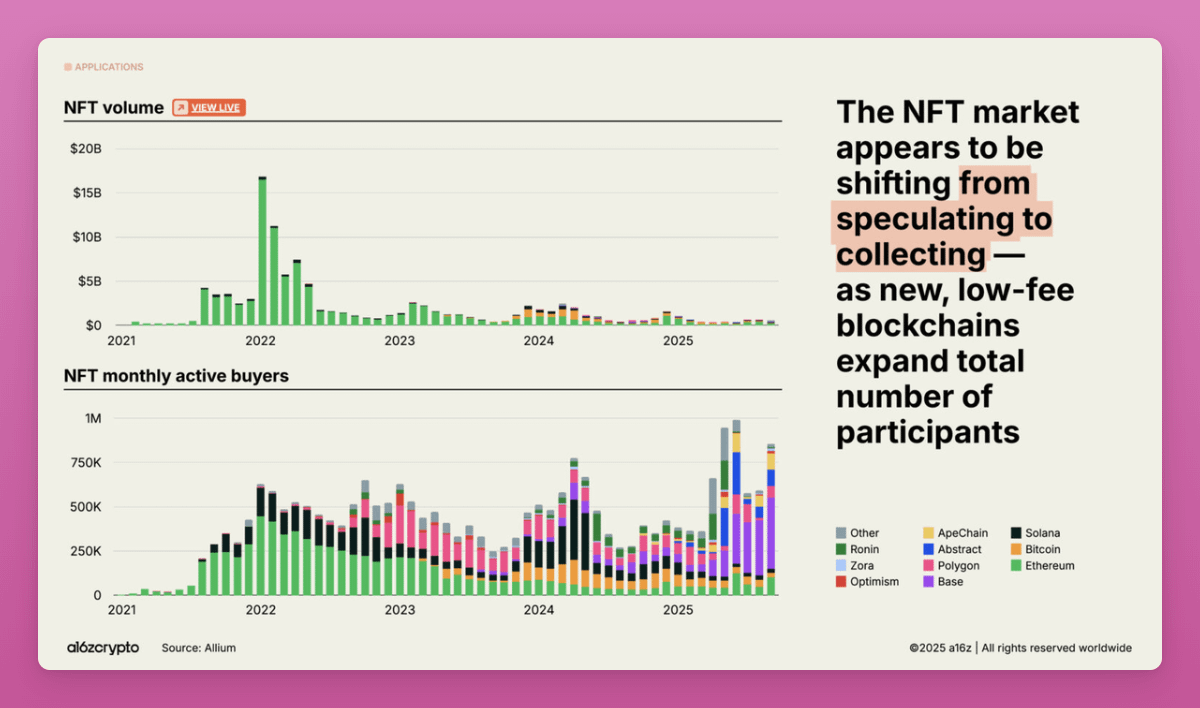

NFTs got hit hard.

Contrary to popular belief, NFTs do have a period of over-performance but they failed to sustain the rally.

We had a modest 4x rally in 2024, followed by a collapse and then another 3x rally in 2025.

NFT market volume is nowhere near its peak in 2022, but the number of monthly active buyers has been growing.

Although this a16z report states that growth is due to “collecting” I believe all the uptick in buyers come from Zora-style posts that convert X-style posts into financially traded NFTs.

The layoffs

Last crypto bear market (2022/23) was brutal for crypto jobs:

according to this Milk Road data, crypto companies laid off up to 50% of workers:

Crypto.com: 2,700 employees (50%+ of workforce)

Coinbase: 2,000 employees (36%)

Kraken: 1,100 employees (30%)

After the market rebounded in 2024-2025, Coincub in their web3 job report found that ‘Web3 added 66,494 new roles in 2025, a 47% rebound from 2024.’

They found that:

Germany collapsed: 22k openings in 2022 to 1,256 in 2025 lol

US growing: 21k roles (up 26%)

70% of placements are still remote

Compliance roles up 35% YoY

“Web3 demand has rebounded and diversified into areas such as compliance, security, and AI-Web3 hybrids.”

Yet after a relative ok 2025, we are starting to see increasing layoffs again.

Polygon Labs: up to 30% after $250M in crypto acquisitions

MANTRA: undisclosed cuts after OM token dumped 90% (it was a scam for sure)

Consensys: at least 7% in July 2025

OKX: undisclosed cuts, global restructuring

DappRadar (liked them a lot): shut down entirely (November 2025)

We saw Lens and Farcaster getting acquired which inevitably leads to staff rotation as well.

I can feel hard times from projects as a co-founder of a KOL studio.

We get less deals, KOLs are decreasing pricing for their paid posts as deals dried up.

What projects are actually announcing has changed

I went through Polygon’s announcements from 2025 as a case study. Here’s what they shipped:

Technical upgrades:

Heimdall v2 Mainnet (July 2025), reduced finality from 90 seconds to 4-6 seconds

AggLayer v0.3 (Q3 2025), cross-chain liquidity sharing

Madhugiri Hardfork (December 2025), 33% throughput increase

Enterprise deals:

Revolut integration for stablecoin transfers

Mastercard partnership for verified usernames in wallets

Wyoming FRNT stablecoin deployment (first US state-issued stablecoin)

Corporate changes:

30% workforce reduction

$250M+ in acquisitions (Coinme, Sequence)

I remember what Polygon and other chains used to announce in 2021-2022: new chains, new token standards, new partnerships with NFT projects, and celebrity deals. Solana is another great case for it (think through Solana announcements in the past).

This pattern holds across most major projects.

They shifted from “we’re launching something new” to “we’re making existing things work better” and “tradfi companies are using our stuff.”

Sure, Avalanche announced their plans to buy most successful ecosystem memecoins but that quickly died out. Instead Avalanche is pushing for DePin integrations or RWAs.

In general, current announcements are less flashy but are more important.

Another big difference is in price after announcements: prices don’t care about any specific upgrades anymore.

This makes crypto less fun but it’s the price of adoption.

User activity: Not so bad!

Shipping is down, but usage and adoption is still up. Sort of.

There are 716 million reported owners of crypto (a16z data) but only 40 to 70m active users (90% gap).

That’s still 6.8% of the world population

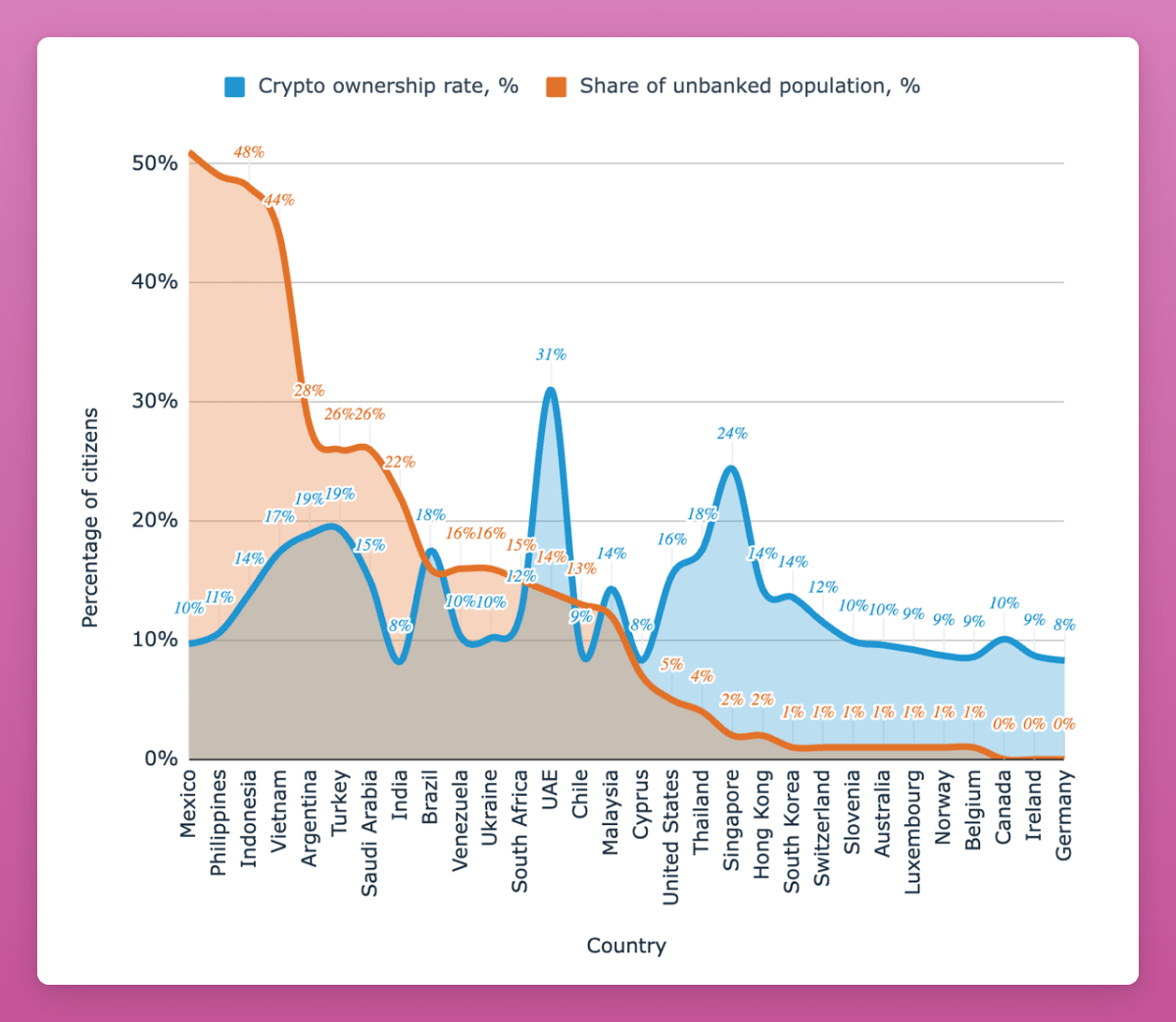

Perhaps my favorite chart is crypto adoption vs share of unbanked population.

Countries with high unbanked populations have high crypto ownership. Crypto is filling a gap where tradfi banking fails.

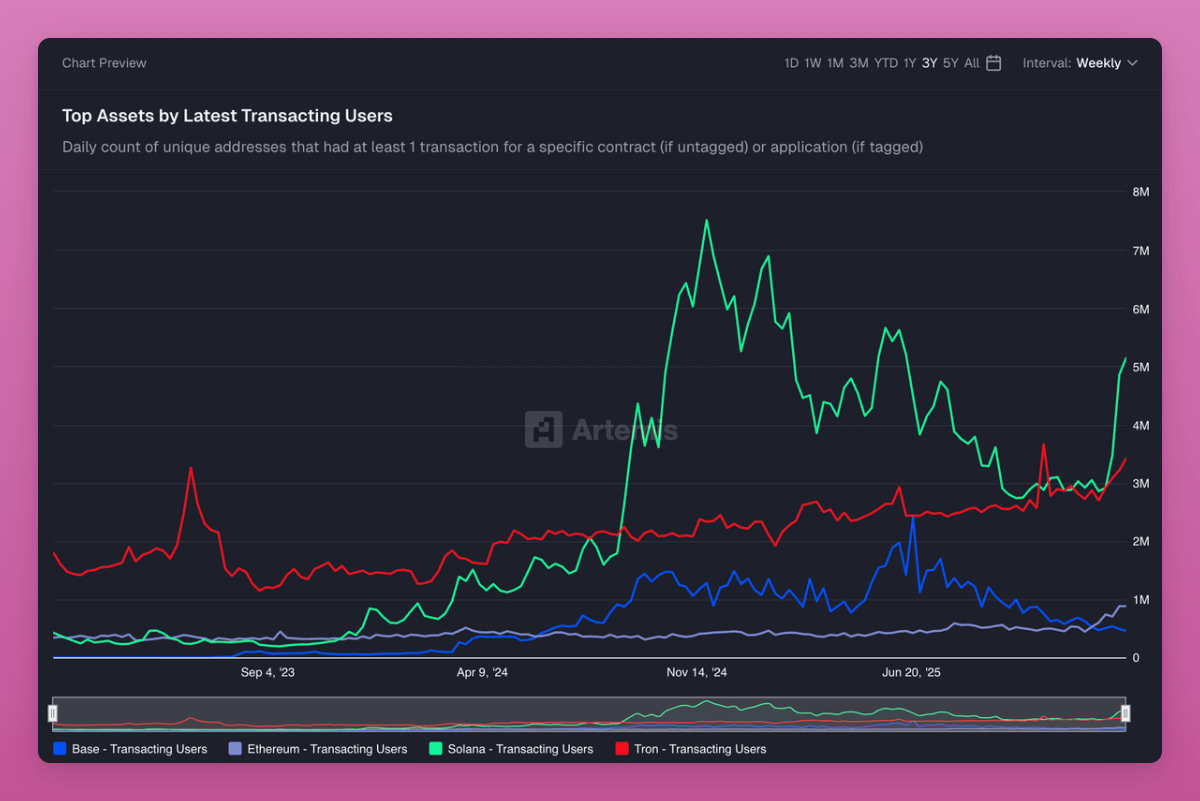

In any case, weekly active users are showing bullish signs.

Solana is finally having a revival of active addresses, Ethereum is picking up too (thanks to scaling hardforks!), and Tron’s users never actually left.

The active users of Tron is perhaps the clearest non-speculative usecase in crypto we have.

What Else Has Changed

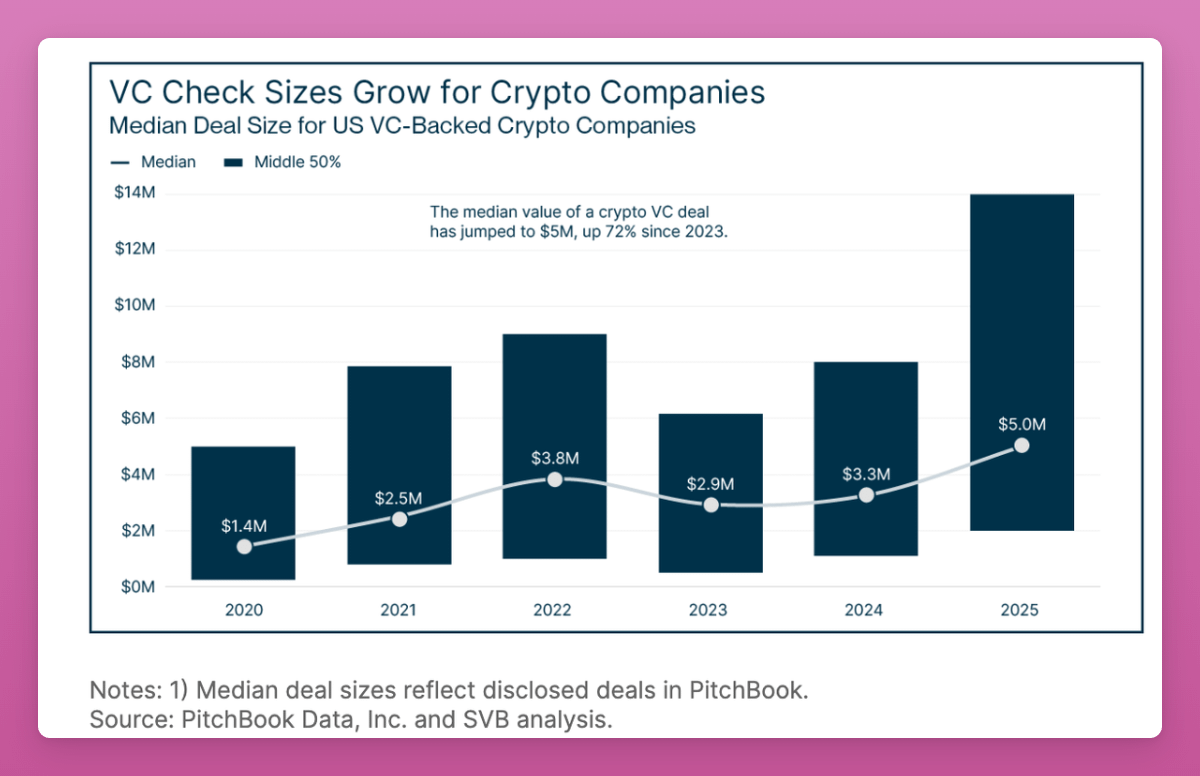

VC funding:

Crypto VC in 2025 invested $16B (up 44% from 2024).

But deal volume dropped 33%. Larger allocations are being given to fewer companies.

Median seed valuations also increased by 70% since 2023.

Existing well-funded teams have money to keep building, but fewer new teams are getting funded.

Source: Silicon Valley Bank

The low hanging fruit got picked (but AI can revive innovation)

In 2020 you could launch a fork of Compound with minor changes and attract billions in TVL. In 2025 every obvious DeFi primitive exists. New launches need to solve harder problems.

Radical innovations dried out and we’re making incremental innovations.

That’s why I believe we should all be brave and launch our AI vibe coded smart contracts. Many will get rekt, but it would drive innovation!

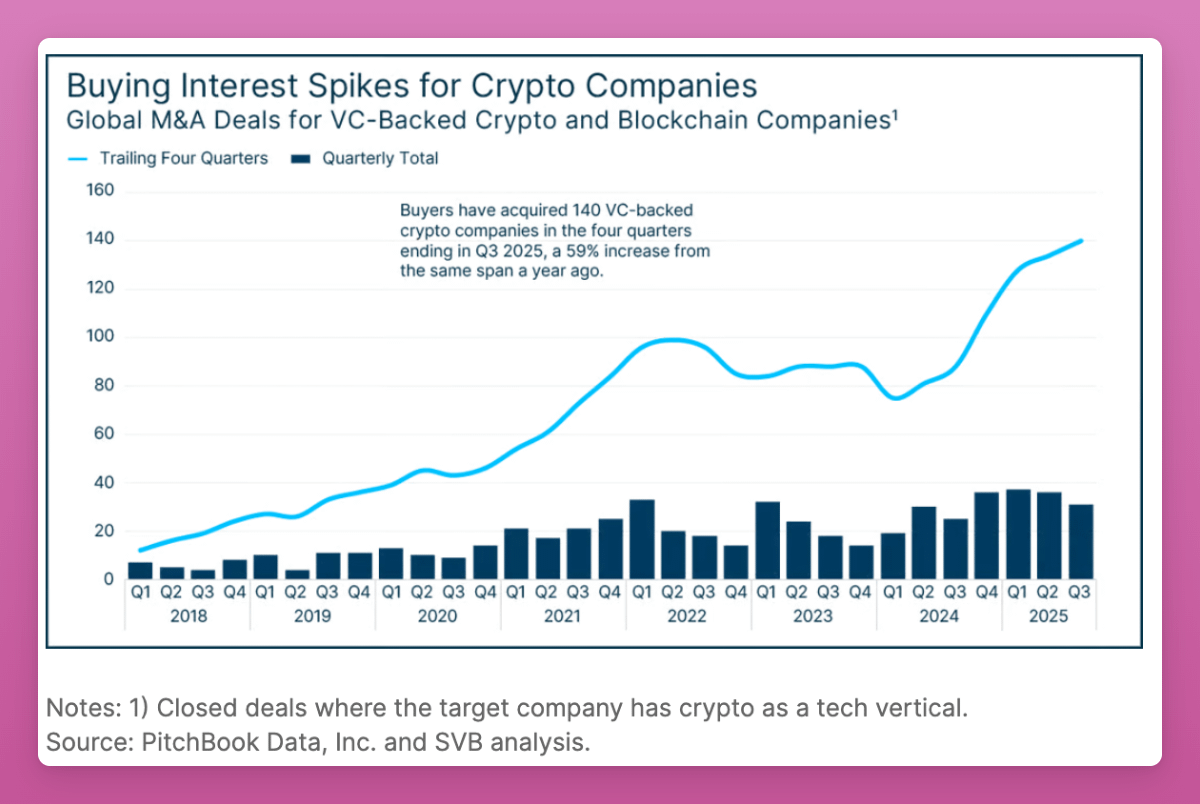

Consolidation accelerated.

M&A reached all time highs.

In the four quarters ending Q3 2025, 140+ VC backed crypto companies were acquired (59% year over year increase).

Coinbase bought Deribit for $2.9 billion. Kraken paid $1.5 billion for NinjaTrader (Wtf?)

Brian Armstrong said in his interview at Davos that acquisitions would increase.

The survivors are consolidating. But they are not buying our tokens :(

Regulatory clarity changed incentives.

The GENIUS Act passed in July 2025. Circle went public. Five crypto companies got OCC bank charter approval (BitGo, Circle, Fidelity Digital Assets, Paxos, Ripple).

This pushes projects toward compliance focused development (slower, less public) rather than move fast and launch.

Instead of token launches we are getting IPOs. They are boring and crypto natives lose out.

AI dominates crypto-native degen mindshare.

Funding is going to AI. And with it the retail mindshare.

My X timeline is now as filled with AI content as with crypto. Despite my best efforts to mute irrelevant content. I can’t mute them all or my X timeline will only be …me.

A lot of talent and capital that might have gone to crypto is going to AI instead.

What this means to you

The old playbook was to find new launches, ape early, sell at TGE.

That playbook required a constant supply of new launches and prices to keep from dumping.

The new playbook might be: find protocols with actual revenue, hold through the boring infrastructure phase, wait for tradfi integration or adoption to drive real usage.

I wrote about it in my truths and lies post. I believe projects like Pendle, Chainlink, or lending protocols that manage to get institutional adoption will outperform the market.

Or another plan sit in stables and wait for the next wave.

The interesting thing is that crypto usage (stablecoins, DEX volume, protocol fees) is growing while crypto shipping (new launches, developer activity, announcements) is shrinking.

Dictionary definition of consolidation.

Good overview, thanks for putting it together.