Scoring Crypto Narratives: My Formula

More than a formula, but a mental model to front-run the next big crypto wave

I bet you've spent countless hours trying to spot the next hot narrative in crypto.

Get it right and you make serious money. Come in late and you become exit liquidity.

The best ROI comes from:

Identifying the narrative early

Mapping the capital‑rotation playbook before everyone else

Exiting at peak inflated expectations

Banking the profit

Then ask: is another narrative wave coming?

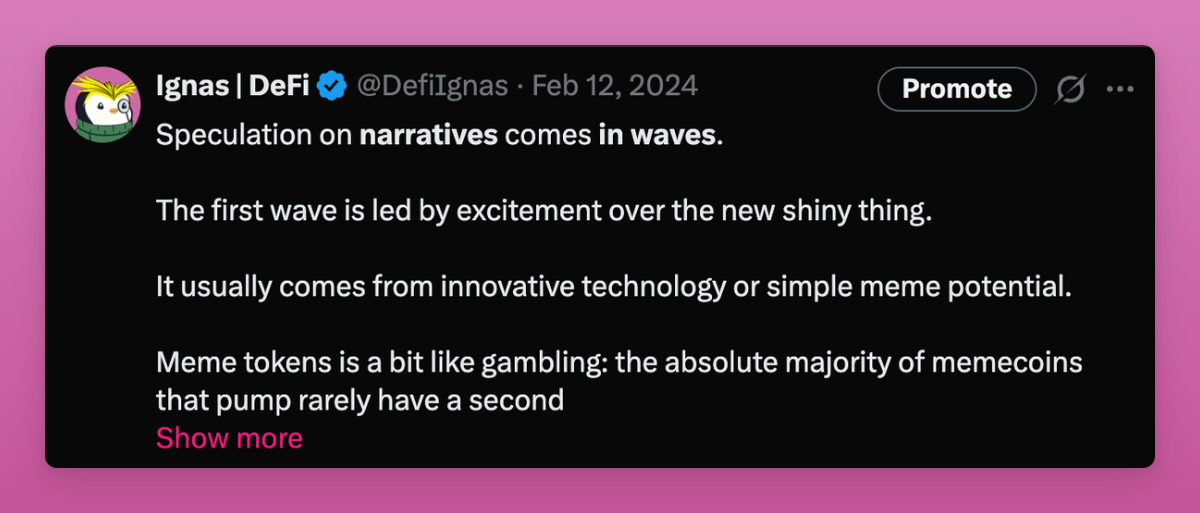

Narratives recycle, but speculation returns in waves when:

The narrative is backed by genuine technical innovation, so it can bounce back after the first‑wave hype fades.

A fresh catalyst appears.

A committed community keeps building after the hype dies.

I wrote more on what I mean in the post below:

Ordinals on Bitcoin is a just an example. You can see clearly the 4 speculative waves from the chart below.