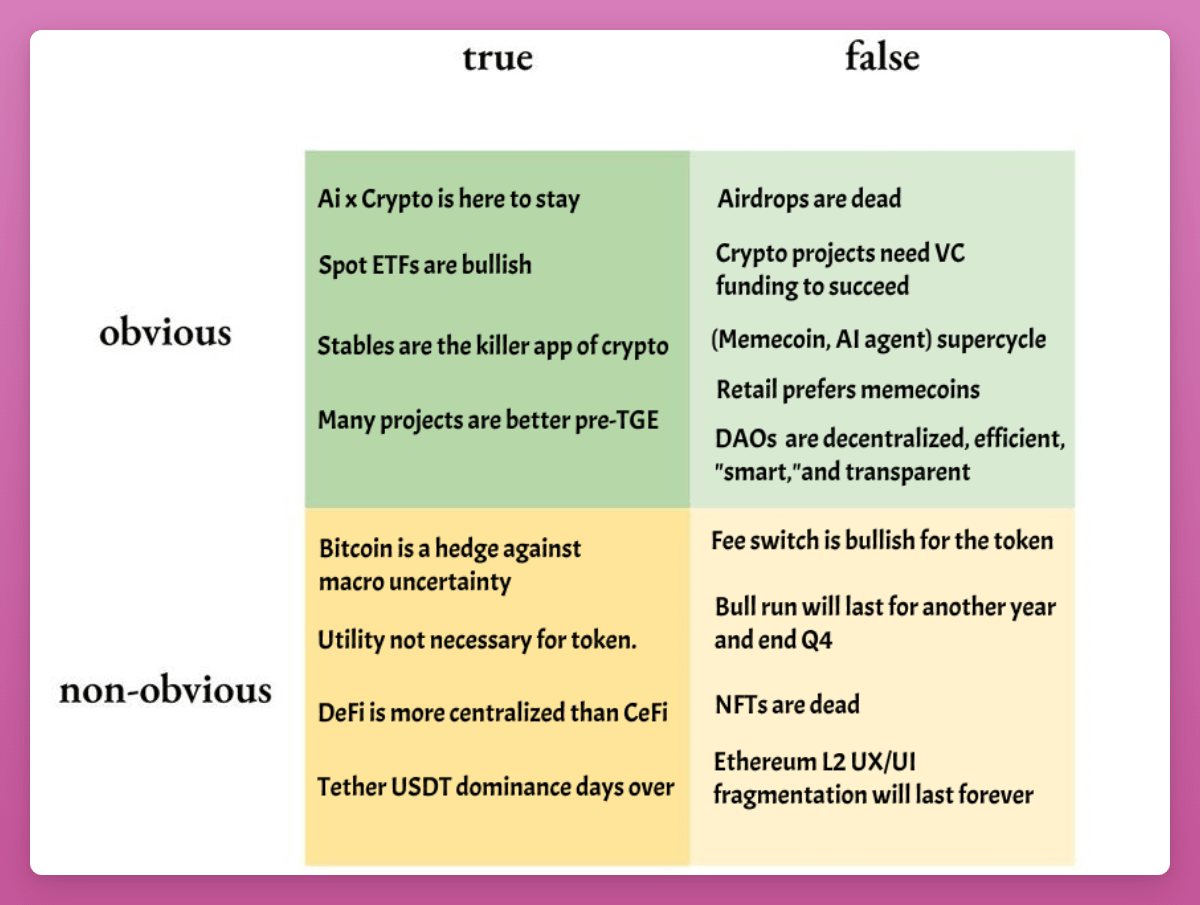

Crypto Truths & Lies: Lessons from 2025

Reviewing the 2025 scorecard before we look ahead to 2026

One year ago I wrote Crypto Truths & Lies for 2025.

Everyone was sharing higher Bitcoin targets. I wanted a different framework to look for where the crowd could be wrong and position differently.

The goal was simple: find ideas that already exist but are ignored, disliked, or misunderstood.

Before I share the 2026 edition, here’s a clean recap of what actually mattered in 2025. What we got right. What we got wrong.

And what we should learn from it.

If you don’t review your own thinking, you’re not investing, but just guessing.